The new report, Australian Construction Outlook – Mining & Processing, provides detailed forecasts for new construction in Australia's resources sector on a project-by-project basis. The report notes that, contrary to initial expectations, the global financial crisis caused a relatively mild and short-lived interruption to resources investment during 2009, and the strong trend growth rate of the past decade is now set to return.

"The global financial crisis caused some deferment of capital expenditures and the cancellation of some projects, and these decisions continued to affect work done volumes into 2009/10," says the report's author and Macromonitor director, Nigel Hatcher.

"With much of the delayed work now re-commenced, the next big upswing in construction will start in 2010/11 and continue through the following three years," according to Mr Hatcher.

"China is the main game for Australia's resources sector, and it has led the way in the recovery of commodity demand," says Hatcher. "And along with the renewed growth in China, and the recovery in commodity prices, the investment environment has been helped by improved availability of finance and increasing port capacity.

"These factors will release the next wave of the mining investment boom over the next few years, as new projects and capacity expansions proliferate across just about all commodity sectors, with the prime movers being LNG, iron ore and coal," says Mr Hatcher.

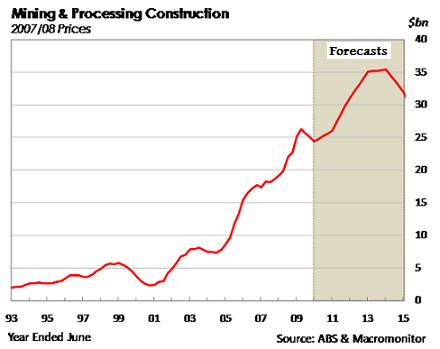

Macromonitor expects four years of growth in mining and processing construction, from the already very high 2009/10 level. The peak is forecast to be reached in 2013/14 at over $35 billion of annual work done (in constant 2007/08 prices), up from around $25 billion in both 2008/09 and 2009/10.

The Macromonitor report identifies a number of key drivers of this next phase of the boom. The most significant factor is expected to be the development of major offshore gas fields and associated LNG projects, primarily in Western Australia but also benefitting the Northern Territory through LNG processing at Darwin and possible developments in the Timor Sea.

Macromonitor also identifies the continued development and exploitation of coal seam gas reserves as a key factor, including the likely go ahead of major coal seam gas to LNG projects at Gladstone. Macromonitor expects two of the five currently proposed Gladstone LNG projects to proceed in the next five years.

Another key driver of the forecasts is a large phase of iron ore development in Western Australia, in both the Pilbara and Mid-West regions. Also, investment in coal is forecast to climb to new heights, driven by Chinese steel making and electricity generation demand. Macromonitor expects large scale development of both thermal and coking coal capacity, predominantly in Queensland.

The report notes that uranium mining developments could also play a role in this next phase of the boom, with a couple of small mines in South Australia likely to be joined at some stage by a big expansion of Olympic Dam, and also by Western Australia's first uranium mines.

Macromonitor also identifies a raft of other new projects and expansions in the pipeline across base metals, gold and other mineral sectors.

After the peak in 2013/14, Macromonitor expects activity to drop back once again over the four years to 2017/18, mainly due the completion of very large oil and gas projects.

-160x160-state_article-rel-cat.png)

-160x160-state_article-rel-cat.png)