Hard Disk Drive (HDD) shortages are likely to have the greatest impact on notebook PCs because the plants affected by the Thai floods primarily make devices designed for mobile computers. The supply hiatus should increase interest in Solid State Drives (SSD), albeit temporarily, says analyst IHS.

With a total of 25 per cent of worldwide HDD assembly facilities located in the country, the serious floods in Thailand are threatening to impact shipments - potentially leading to a serious shortage of the computer memory.

While it’s too early to gauge the full extent of the impact of the floods, HDD supplies are likely to be constrained throughout the fourth quarter and into 2012, according to Fang Zhang, a storage analyst at HIS.

The PC industry appears to have sufficient stockpiles to last through the fourth quarter, so a disruption to notebook shipments is unlikely to occur in 2011. But with HDD production disruptions stretching into the first quarter of next year, an eventual slowing in notebook manufacture is inevitable, says the company.

IHS expects the notebook supply chain to begin to adjust to the impact of the disaster from the second quarter of next year, by obtaining HDDs from alternative sources in different regions and using other types of storage solutions, including SSDs. Such a workaround will allow the notebook supply chain to mitigate some of the impact of the HDD shortage.

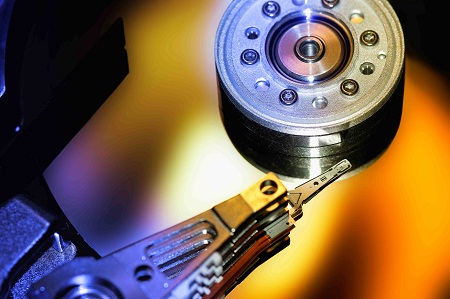

The uptake of SSDs has so far been limited to premium portable computers such as Apple’s MacBook. The drives are based on NAND flash memory and have no moving parts so tend to be more reliable than HDDs - which have several mechanical components.

According to IHS, because the price gap between SSDs and HDDs remains high, and the process of redesigning models to equip SSD will take several months, SSD adoption is still likely to be limited to the high-end and corporate market; specifically, models that were designed to support both HDD and SSD from the outset.

This relatively limited demand for SSD in the last quarter of this year and into 2012 is unlikely to cause shortages of the devices or the NAND memory from which they are fabricated.

In a Reuters report, Jun Dong-soo, president of Samsung’s memory business said: "It is true that we are seeing more orders, albeit not many, for SSD after the flood. It will take time [for] the SSD penetration rate [to] become double-digit [from the current 3 to 4 per cent]".

In another fallout from the worst Thai floods in half a century, the DRAM market could be negatively impacted by slowing sales of notebook PCs. Any reduction in PC sales due to supply chain constraints will further depress the already oversupplied DRAM market, pushing down prices.

The Australian embedded computing sector is unlikely to be immune from shortages as products from suppliers such as Advantech and ICP rely on HDDs in much the same way as consumer PCs.

SSDs have started to catch on the industrial sector but only have about a 10 per cent market share because of their price premium. However, there is a third option.

"Some of our customers compromise by using cheaper CompactFlash drives of up to 16 GBytes as the mass storage on their embedded computers," Walter Breunig, a Director of Dedicated Systems Australia, a supplier of real time and embedded computing products, told IndustrySearch in a report earlier this year.

2-160x160-state_article-rel-cat.png)