Two consultancy companies that track the photovoltaic (PV) market have independently noted that falling prices for silicon-based solar modules have changed their demand forecasts for 2012.

One says cheaper modules will stimulate the market while the other claims that, while they’ll help, lower prices alone won’t be enough to compensate for reduced incentives to adopt solar power.

California-based IHS iSuppli says that a "historic" milestone will be reached in the first quarter of 2012 when the price of crystalline silicon (c-Si) modules is forecast to drop below US$1-per-Watt (A$0.93-per-Watt) for the first time.

The company says the prediction follows a rapid decline in pricing for deals struck at the Intersolar Trade Fair, site of the world’s largest PV exhibition, held during June in Munich.

Prior to Intersolar, spot prices from the top Chinese brands, among the major players in the market, had been running at US$1.49-per-Watt (A$1.39-per-Watt) for mainstream c-Si modules. At the end of the exhibition, prices had fallen to US$1.30-per-Watt (A$1.21-per-Watt).

"Not only could such a development ward off a dip predicted in solar installations for 2012, it also signals that deep-pocketed and lower-cost structured companies will be getting aggressive about pressuring competition out of the market during the next year," Mike Sheppard, analyst for photovoltaics and financial services at IHS, said.

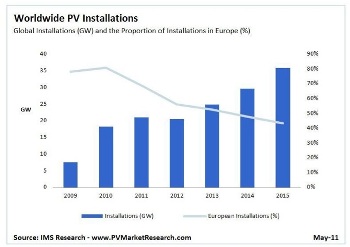

UK-based IMS Research is more circumspect in its assessment of how much demand falling prices will generate. In its latest report the company has raised its forecasts for 2011 - saying that more than 21 Gigawatts of new global PV capacity will be installed - based on: "new information on supply chain pricing which will help stimulate demand in major markets".

However, the firm also cut its long-term forecast slightly due to decreasing incentives in several markets. The company is predicting a single-digit decline for PV installations in 2012 due: "both to the falls forecast in Europe but also the uncertainty in the USA and Asia".

"[Development] in 2012 will be entirely dependent on reducing costs rapidly enough in order to keep prices in line with incentives in major markets," IMS’ Ash Sharma said.

"Although margins are now being squeezed and prices are beginning to fall, further reductions are needed in 2012."

In Australia, while there is no country-wide incentive scheme, most states offer feed-in-tariffs (FiT) whereby PV installation owners are paid to connect to the grid and supply power. Current FiT rates vary from 60c/kWhr in Victoria to 20c/kWhr in Tasmania. However, FiTs are subject to constant revision. Moreover, several states, including NSW and ACT, are scaling back other incentives by closing them to new applicants.

Rodger Meads, Managing Director of Conergy Australia, a subsidiary of Germany’s Conergy AG - which claims to be one of the largest suppliers and system integrators of solar power in Europe - is optimistic about the local sector next year.

"Despite some revision of the PV incentive schemes here, the Australian market is healthy and we look forward to positive growth potential in 2012," Meads said.

"Conergy’s German-engineered technology has gained a solid reputation in Australia because of its suitability to our climate and the enduring innovation behind the products."