New materials and advances in electronics will combine to allow sensors to shrink and rely on new operational principles, claims analyst Frost & Sullivan in a new report entitled "World Emerging Sensors Market". This in turn will allow sensors to be used in new applications and fuel sector growth.

Established sensing principles such as piezoresistance, capacitance and inductance, will be joined by new techniques enabled by materials like silicon carbide (SiC), carbon nanotubes (CNT) and indium antimonide (InSb).

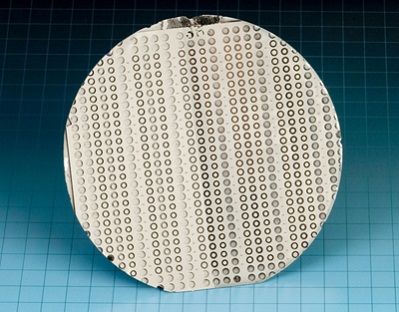

Due to its ability to withstand temperatures above 300C, SiC promises to replace silicon in microelectromechanical systems (MEMS)-based sensors used in harsh environments such as vehicle exhausts or industrial incinerators. Carbon nanotubes enable nanoscale sensors for detection of gases and volatile organic compounds (VOC) while InSb is suitable for both infrared (IR) detection, and sensing of very weak magnetic fields.

Frost & Sullivan says over the next decade, these new materials will play a key role in sensor miniaturisation and allow instrumentation manufacturers to improve the performance, reliability, longevity and cost of their devices. Smaller sensors with enhanced capabilities will lead to innovative measurement techniques and new markets.

The company notes that the rapid growth in consumer electronics, increasing concern about border security, nuclear power plant safety concerns and the threat of damage to the environmental will encourage pioneering users to deploy these new types of sensors.

However, in a note of caution, Frost & Sullivan says despite the potential of new instrumentation many users still prefer traditional technologies, due to inadequate knowledge of new technology and its application.

"Vendors therefore need to educate end users about the benefits of advanced and emerging sensor technology through literature," the company said in a statement.

"Small form factor, [lower] power consumption, higher feature integration, and low costs are some of the trends driving sensors market growth," Frost & Sullivan Research Analyst V Sankaranarayanan, said,

"[But] to produce sensors using advanced materials at reasonable costs and in large volumes, manufacturers have to optimise processes that are compatible with silicon to reduce the cost of commercialisation."

Meanwhile, another analyst, US-based BCC Research, has noted that after the downturn in 2009, the global market for sensors bounced back to US $56.5 billion ($55.5 billion) in 2010. It is expected to increase to US $62.8 billion ($61.6 billion) by the end of this year and then to nearly US $91.5 billion ($89.8 billion) by 2016, at a compound annual growth rate (CAGR) of 7.8 per cent.

Sensors using new technology are yet to contribute significantly to this total being currently limited to esoteric scientific applications. SiC sensing arrays, for example, are being used to detect trace levels of gas emitted by active volcano vents. The volcanic gases are highly corrosive, preventing the use of sensors using conventional electronics.

Availability of emerging sensors is as yet rare in the Australian market, but the sector is well served by current technology. Companies such as Applied Measurement and WIKA supply a comprehensive range of temperature, pressure and humidity sensors and data acquisition technology.

-160x160-state_article-rel-cat.png)