"In order for Australian companies to compete globally, they must increasingly achieve scale, keep pace in their process technologies, and supply higher value products," Executive Director of the Australian Advanced Manufacturing Council, Jennifer Conley said.

"These tax changes support that growth. Ensuring these entities gain full and reasonable benefit from ATO allowances for small business will support their growth and continued viability into the future.

"We called for an increase of the threshold to $20 million turnover in our Pre-Budget Submission. We’re delighted they have met us half-way," she said.

"Revising the threshold to better reflect the reality of viability for a small business will allow Australian companies to operate on a more level playing field vis-à-vis their overseas competitors.

"By contrast, in the European Union, a small business is one with less than 50 employees and also an annual turnover of below 10 million Euros; in the US, a small business employs up to 500 employees.

"Australian advanced manufacturers are achieving great things in the face of intense global competition. But the conditions are tough.

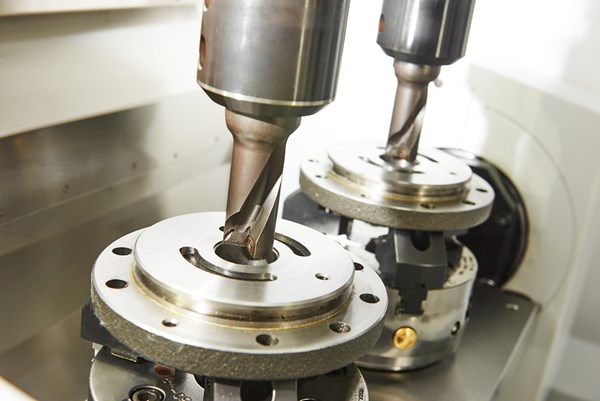

"Right now, significant technological shifts are occurring in manufacturing: commercial applications for artificial intelligence and machine learning are expanding; we see robotics entering a new phase; significant advances are occurring in nanotechnology, 3D printing, genetics, biotechnology, chemistry and materials science.

"Companies must keep pace globally. This requires accelerating the uptake and development of technology and processes across industry. Lowering the corporate tax rate over time is a positive support for the ambition of many of our small businesses to become medium-sized – and even large-sized."